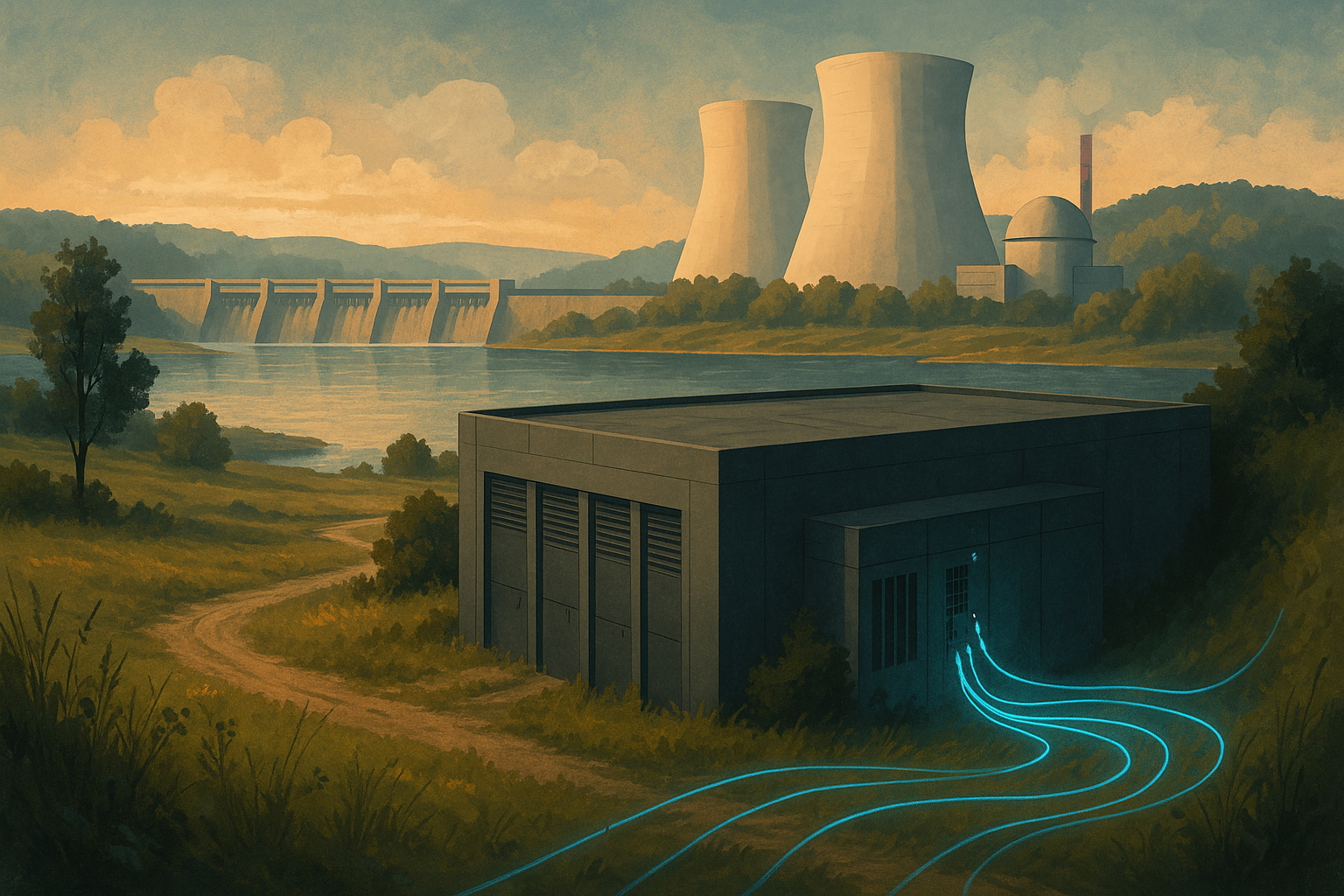

Eastern Europe is emerging as a new frontier for energy-intensive computing, driven by the presence of unique “energy islands” regions with surplus power generation capacity, often from nuclear or hydroelectric sources, coupled with limited grid connections to export this excess energy. This phenomenon, particularly evident in Slovakia, Romania, and parts of Western Ukraine, creates pockets of stranded, low-cost electricity that are proving highly attractive to power-hungry operations like AI training, high-performance computing, and cryptocurrency mining.

The Allure of Surplus Power

These energy islands offer compelling advantages. Firstly, ultra-low energy costs are the primary draw. Electricity, often the largest operational expense for data centers, can be sourced at significantly reduced rates, sometimes through direct Power Purchase Agreements (PPAs) with generators or via behind-the-meter connections that bypass grid fees and taxes. Slovakia’s expanding nuclear capacity (Mochovce, Jaslovské Bohunice) and Romania’s abundant hydro (Iron Gate) and wind power create pools of cheap, stable baseload or off-peak energy.

Secondly, these operations leverage energy arbitrage, converting inexpensive local electricity into high-value digital products for the global market. Locating a multi-megawatt AI facility near a Slovak reactor or in a Romanian hydro valley offers drastically lower cost-per-computation compared to traditional hubs in Western Europe.

Thirdly, co-location incentives and infrastructure readiness play a role. Utilities and governments, keen to monetize surplus power and reduce grid strain, sometimes offer deals for data centers to site directly at or near power plants. Ukraine’s Energoatom, for instance, had pre-war plans to host large data centers at nuclear sites like Rivne NPP. Such arrangements offer reliable power and sometimes access to plant cooling infrastructure.

Finally, natural cooling advantages in these often rural, cooler climates, combined with access to water sources near hydro and nuclear plants, allow data centers to achieve higher energy efficiency (lower PUE ratios), further amplifying cost savings.

The Emergence of “Ghost” Data Centers

This confluence of factors is fostering the growth of low-visibility or “ghost” data centers. These facilities often operate discreetly:

- Behind-the-Meter: Connecting directly to power generation avoids public tariffs and grid scrutiny, making their energy consumption less visible in national statistics.

- Specialized Co-Location: Firms like Romania’s EvoBits or F2Hash establish facilities in power-rich zones (e.g., near Iron Gate), marketing cheap compute capacity to international clients needing AI or mining horsepower.

- Regulatory Grey Zones: Operations often exploit lenient or non-specific regulations surrounding crypto mining or large-scale compute, keeping a low profile to avoid prompting stricter oversight.

- Minimal Public Visibility: Sited in non-descript warehouses or on power plant grounds, they attract little attention, enhancing their “ghostly” nature.

Regional Dynamics and Infrastructure

- Slovakia: With growing nuclear output, offers stable, competitively priced baseload power and robust grid/digital infrastructure, particularly near its power plants.

- Romania: Benefits from low regulated electricity prices (though potentially temporary), a mix of hydro/wind/nuclear, improving fiber connectivity, and supportive policies for large tech investments (e.g., ClusterPower campus).

- Western Ukraine: Possesses significant nuclear/hydro capacity historically creating surpluses. Despite wartime risks, low energy costs and existing infrastructure (including westward grid connections) continue to attract compute operations, notably crypto mining, albeit under challenging security conditions.

High Risks Meet High Rewards

Investing in these energy islands presents a compelling but risky proposition. The potential for dramatically lower operating costs and first-mover advantages is significant. However, investors face:

- Geopolitical and Security Risks: Particularly acute in Ukraine, but political shifts and FDI scrutiny are factors even in stable EU members like Slovakia and Romania.

- Regulatory Uncertainty: Policies on energy pricing, crypto mining, and data center energy use could change, eroding cost advantages.

- Infrastructure Hurdles: Building and operating sophisticated facilities in remote areas can pose logistical and talent-related challenges.

- Market Evolution: Increased competition or grid upgrades exporting surplus power could diminish the arbitrage opportunity over time.

Furthermore, the allure of cheap power fuels illicit activity, including electricity theft and insider misuse of infrastructure, necessitating robust governance and enforcement.

Outlook: A New Geography of Compute

The rise of compute farms in Eastern Europe’s energy islands highlights a fundamental trend: the global distribution of digital infrastructure is increasingly shaped by energy economics. While navigating the political, regulatory, and operational risks requires careful due diligence, these regions offer a potentially lucrative frontier for investors willing to venture into environments where power is abundant and cheap. This dynamic is likely to continue, potentially transforming these energy islands into significant, albeit often low-profile, hubs in the future of computation.

Read our full Report Disclaimer.

Report Disclaimer

This report is provided for informational purposes only and does not constitute financial, legal, or investment advice. The views expressed are those of Bretalon Ltd and are based on information believed to be reliable at the time of publication. Past performance is not indicative of future results. Recipients should conduct their own due diligence before making any decisions based on this material. For full terms, see our Report Disclaimer.