In the aftermath of World War II, as nations rebuilt and universities expanded, economics underwent a radical transformation that would shape–and arguably cripple–the discipline for decades to come. Two ambitious economists, Paul Samuelson and John Hicks, led a revolution that promised to turn their field into a hard science through mathematical rigor. Today, one maverick economist argues their victory was actually a devastating wrong turn, and he’s proposing a provocative new map for finding our way back.

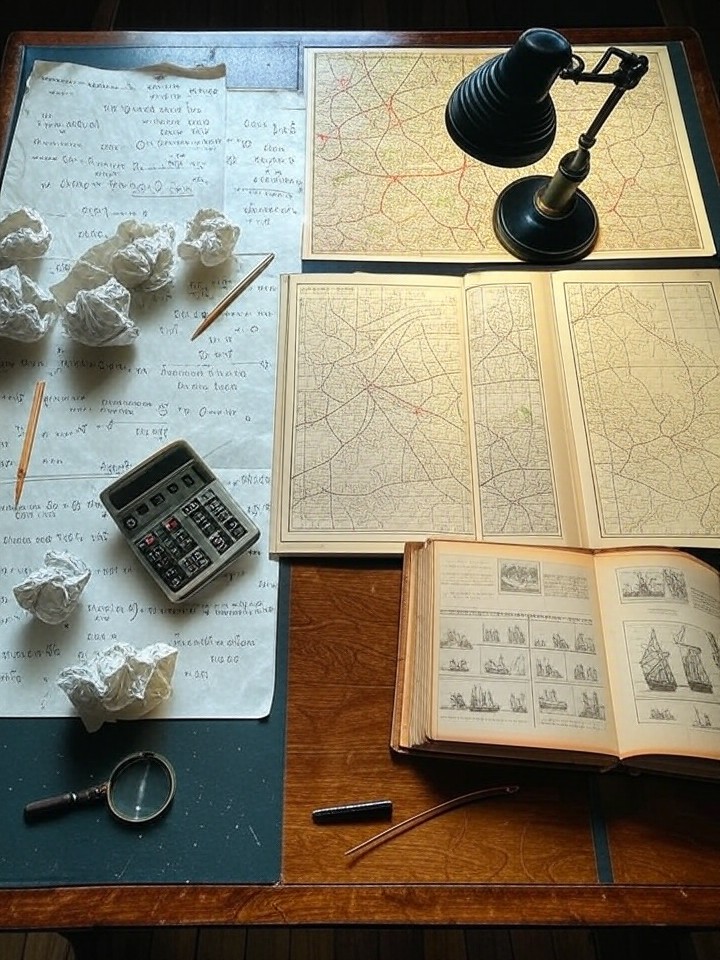

Meir Kohn spent years as a mathematical modeler, crafting elegant equations that were supposed to explain how economies work. Then something unexpected happened: while writing a textbook on finance, he dove into financial history for background material and discovered that historical narratives explained far more about real economies than his abstract models ever could. “I switched from mathematical modeling to deriving theory from the observation of actual economies,” Kohn recalls–a shift he likens to abandoning Plato’s ideal forms for Aristotle’s empirical observations.

What Kohn discovered through his historical detective work was both simple and radical: mainstream economics had become obsessed with studying just one slice of economic life–production and pricing–while ignoring two other fundamental ways humans make their living. He calls these missing pieces “commerce” and “predation.”

Commerce encompasses all the middleman activities that make markets work: merchants, traders, financiers, anyone who profits by moving goods from where they’re abundant to where they’re needed. Predation is the uncomfortable truth economists prefer to ignore: the use of force or power to extract wealth, whether by bandits, tax collectors, or regulatory capture. Together with production (making things), these form the trinity of economic life.

The implications cascade from there. Conventional economics, fixated on mathematical equilibrium, assumes economies naturally rest in balance until some external shock disturbs them. But Kohn’s historical analysis revealed something different: economies are perpetual motion machines, constantly evolving as entrepreneurs seek profit, merchants expand markets, and predators devise new extraction schemes. “The only economy in equilibrium is a stagnant economy,” he argues pointedly.

This dynamic vision helps explain phenomena that puzzle mainstream economists. Why do some nations grow rich while others stagnate? The conventional answer involves vague hand-waving about “institutions” or “culture.” Kohn’s framework offers concrete mechanisms: when commerce expands, it creates incentives for specialized production and technological adoption. When predation dominates–through war, corruption, or extractive government–it strangles commerce and growth collapses.

Medieval Europe provides a compelling case study. In the 11th century, most production was subsistence farming, commerce was minimal, and the predatory nobility extracted wealth through feudal dues. Then long-distance trade began expanding. Suddenly, farmers had reasons to produce surpluses for market, artisans could specialize, and long-dormant technologies found profitable applications. The Commercial Revolution was born–until the predatory wars of the 14th century strangled it.

This historical pattern reveals another crucial insight: governments aren’t neutral referees but economic actors choosing between two strategies. “Predatory governments” centralize power to extract resources, often for warfare and elite consumption. “Associational governments” emerge from commercial classes and protect property rights and contracts, enabling commerce to flourish. The divergence explains why the Dutch Republic and England, with their merchant-influenced governments, eventually outpaced absolutist France and Spain.

Kohn’s critique arrives at a moment when economics faces a crisis of credibility. The 2008 financial collapse blindsided a profession whose models couldn’t even conceive of such systemic failure. Students worldwide have demanded more realistic economics education. Even Nobel laureates have accused their colleagues of “mathiness”–mathematically impressive but empirically vacuous theorizing.

The backlash has produced strange bedfellows. Complexity scientists at Santa Fe Institute argue economies resemble ecosystems more than machines. When they model economies as adaptive systems rather than equilibrium-seekers, they naturally produce booms, busts, and innovation–phenomena that mystify conventional theory. Nassim Taleb, the iconoclastic scholar-trader, more colorfully demands economists “think like engineers, not economists,” building robust systems rather than assuming away inconvenient realities like financial crashes.

Academic economics, meanwhile, has become what Kohn calls a “bureaucratized” discipline. Career incentives favor publishing incremental technical papers over tackling big questions. As he wryly notes, “deans can’t read, but they can count”–so quantity trumps quality. Young economists learn to play it safe within established paradigms rather than risk challenging orthodoxy.

The solution isn’t abandoning mathematical rigor but expanding economics’ vision. Kohn’s framework doesn’t replace price theory–it provides context for when and how prices matter. Sometimes market expansion drives growth; sometimes predatory extraction kills it. Sometimes cultural shifts enable commerce; sometimes they’re symptoms of deeper institutional changes. The framework is modular, welcoming insights from behavioral economics, institutional analysis, and other subfields that conventional theory awkwardly accommodates.

Critics might dismiss this as a return to outdated classical economics. Kohn cheerfully agrees–up to a point. Adam Smith and his contemporaries studied economies as evolving social systems, not static mathematical constructs. They understood that commerce, predation, and production interweave in complex ways. The difference is that Kohn brings modern empirical evidence and systematic analysis to classical insights.

The stakes extend beyond academic debates. If economics continues mistaking elegant equations for reality, we risk building fragile systems that shatter under unexpected stress–whether financial crises, pandemics, or technological disruption. A framework that acknowledges economies’ evolutionary nature, the crucial roles of commerce and power, and the social embeddedness of economic life might help us build more resilient, adaptable systems.

Economics took a wrong turn after World War II, choosing mathematical elegance over messy reality. Kohn’s commerce-predation framework offers a way back–not to abandon rigor, but to embrace the full complexity of human economic life. Whether the discipline will take this path remains uncertain. But as crises mount and conventional models fail, the cost of staying lost keeps rising.

Read our full Report Disclaimer.

Report Disclaimer

This report is provided for informational purposes only and does not constitute financial, legal, or investment advice. The views expressed are those of Bretalon Ltd and are based on information believed to be reliable at the time of publication. Past performance is not indicative of future results. Recipients should conduct their own due diligence before making any decisions based on this material. For full terms, see our Report Disclaimer.